Exploring the future of digital economy

Solana vs. Ethereum: Key Metrics for June 2025

Summary

-

-

- Solana experienced a significant decline in key performance metrics in June 2025:

- REV (revenue from fees and operations): $63 million, down 48% MoM

- App Revenue: Fell to $150 million (-38%)

- DEX Trading Volume: Dropped to $90 billion (-35%)

- Despite declines, Solana remains the leader in app revenue share (35%) and dominates the meme coin market (61% of volume)

- On June 30, xStocks launched — enabling trading of tokenized U.S. equities

- Ethereum continued attracting institutional capital:

- ETH ETF inflows reached $1.2 billion , the second-best month ever

- Declining futures funding rates indicate more cautious trader behavior

- Stablecoin volumes on ETH hit ATH

- Ethereum is emerging as the core infrastructure for RWA (Real World Assets), which could grow to $40–120 trillion by 2030–2034

- In the U.S., new legislation (the Genius Act) could push stablecoin volumes to $2 trillion, reinforcing Ethereum’s dominance

- Solana experienced a significant decline in key performance metrics in June 2025:

-

Solana Performance – June 2025

Key Metrics Overview

In June, Solana saw a notable contraction across its major on-chain indicators:

Revenue (REV)

-

-

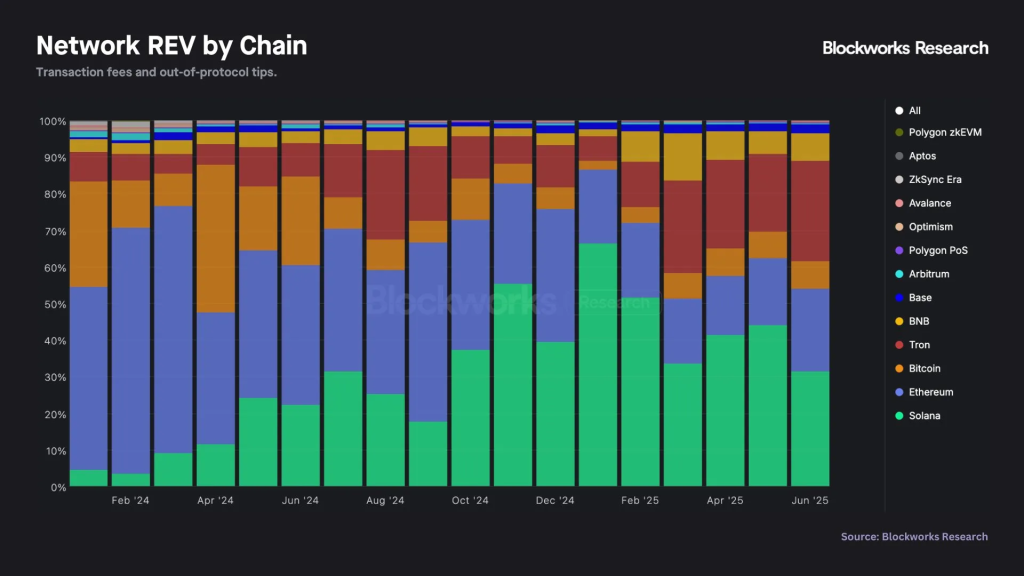

- Total transaction and operational revenue (REV) stood at $63 million, representing a 48% drop from May

- However, Solana increased its global REV market share to 31%, surpassing both Tron (28%) and Ethereum (23%)

-

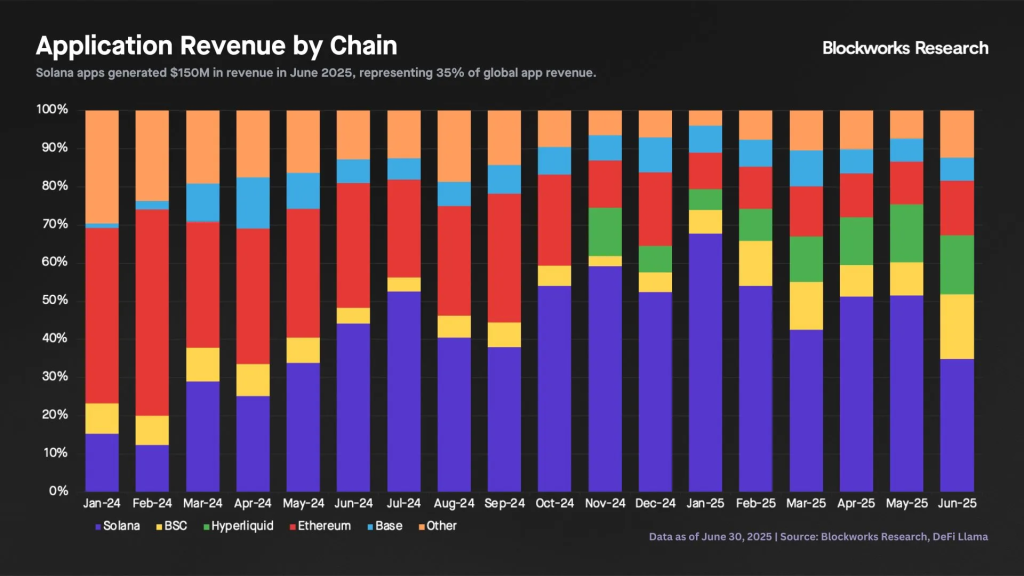

Application Revenue

-

-

- App revenue totaled $150 million, down 38% MoM

- Solana retained its position as the blockchain with the highest app revenue share (35%), ahead of BSC (17%)

-

Top Revenue-Generating Apps (June 2025):

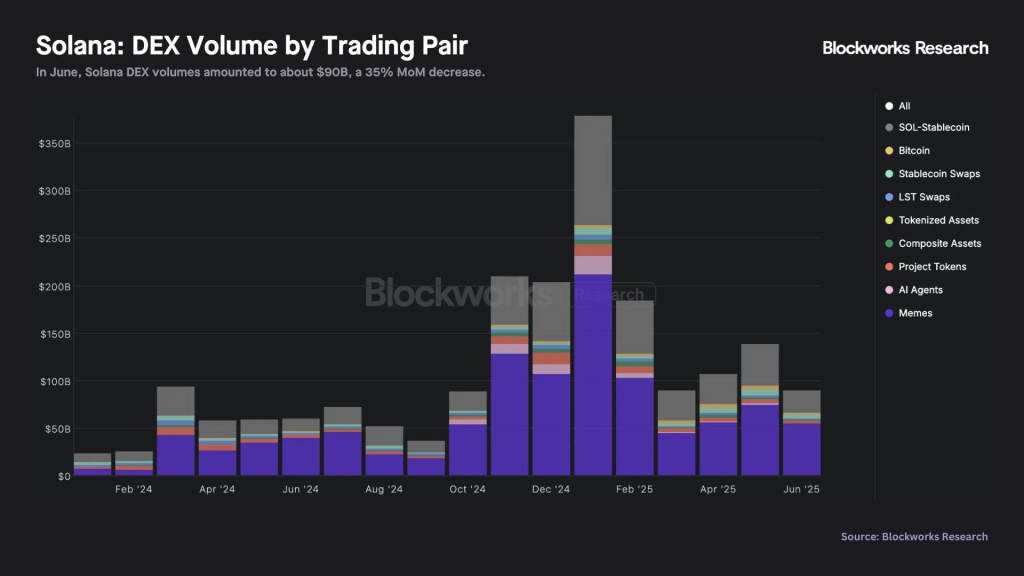

DEX Trading Volume

-

-

- Total DEX volume fell to $90 billion , a 35% decrease from May, but still 50% higher YoY (vs. June 2024)

- Approximately 61% of this volume was attributed to meme coins

-

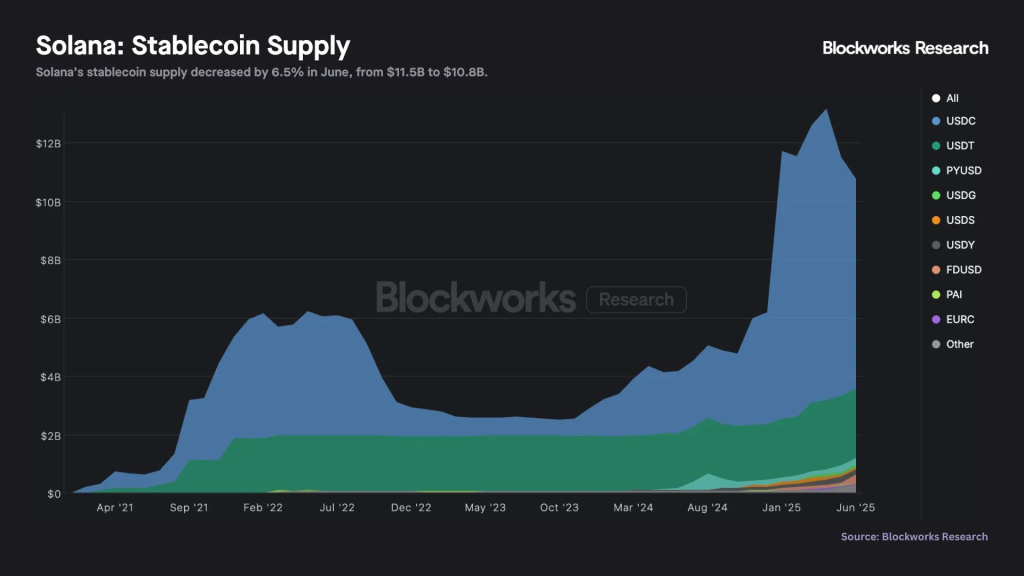

Stablecoin Supply

-

-

- Stablecoin supply declined by 6.5% to $10.8 billion

- USDC dropped by $1 billion (-12%)

- FDUSD tripled from $104 million to $304 million

- Stablecoin supply declined by 6.5% to $10.8 billion

-

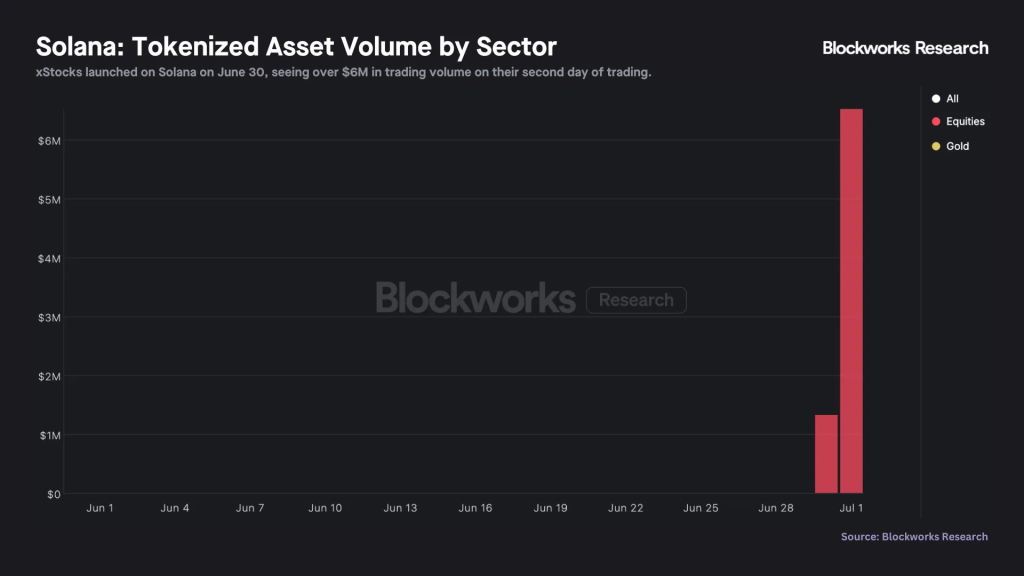

New Launches

-

-

- xStocks launched on June 30, enabling users to trade tokenized U.S. equities

- First-day transaction volume on July 1 was $8 million

- On July 2, the first SOL ETF debuted in the U.S. with a trading volume of $33 million on day one

- xStocks launched on June 30, enabling users to trade tokenized U.S. equities

-

Ethereum Performance – June 2025

Key Metrics Overview

Ethereum continued to draw institutional interest during June 2025:

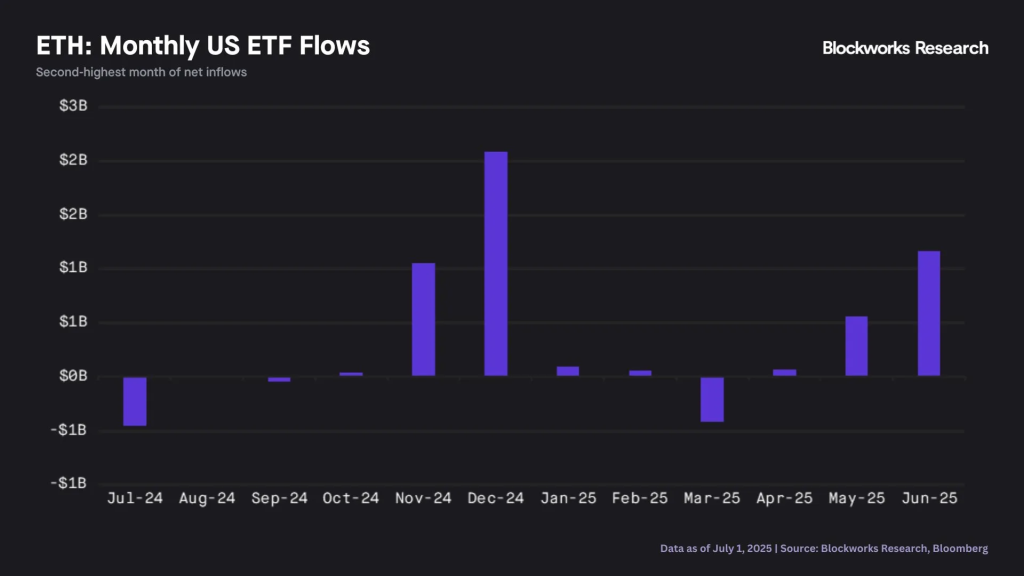

ETF Inflows

-

-

- ETH ETF inflows totaled $1.2 billion, marking the second-highest monthly inflow since launch

-

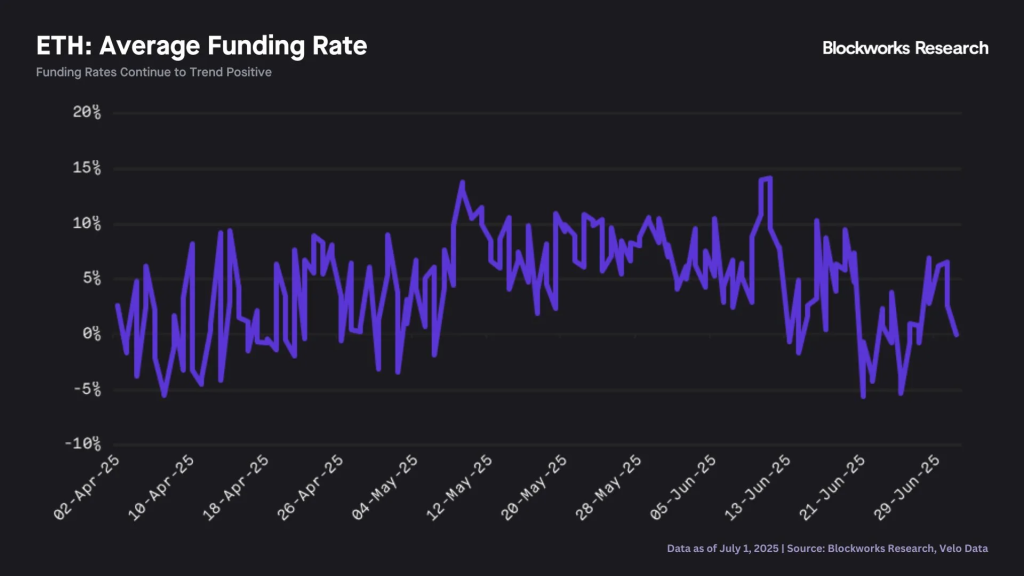

Futures Funding Rates

-

-

- The funding rate between longs and shorts on perpetual futures dropped from 6.7% in May to 4.6% in June, signaling increased caution among traders

-

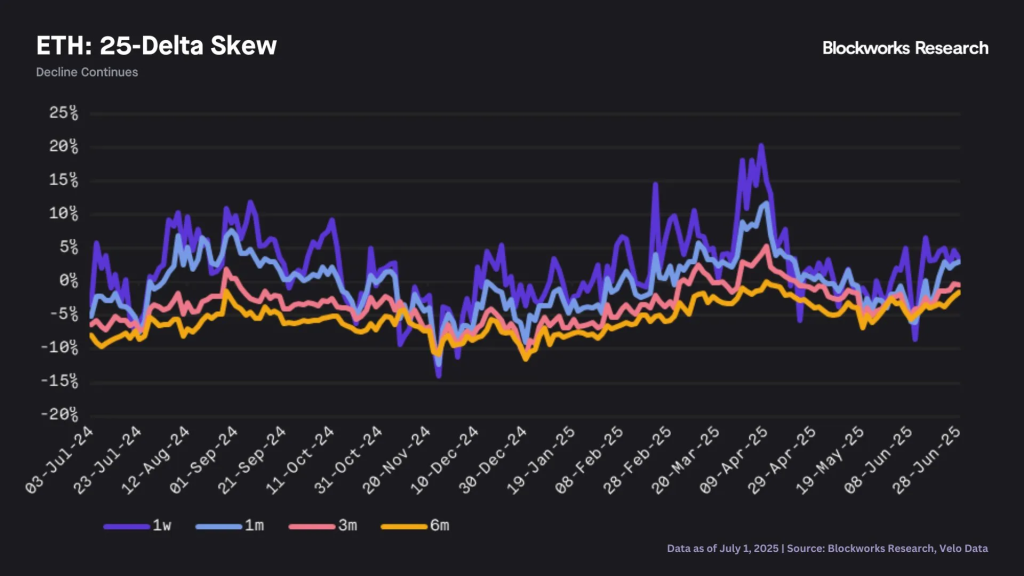

Options Market Sentiment

-

-

- Short-term options showed a shift from bullish bets to hedging against downside risk

- Long-term sentiment remained cautious but began showing signs of improvement

-

Fundamental Indicators

Stablecoins

-

-

- Stablecoin value on Ethereum hit an all-time high (ATH)

- Ethereum holds $126 billion out of $258 billion total stablecoin market cap

-

Market Share in REV

-

-

- Ethereum’s share of transaction fees and revenue (REV) was 23%, trailing behind Solana and Tron

-

Growth Catalysts: RWA, DeFi & Stablecoins

Ethereum is increasingly seen as the foundation for future global financial infrastructure.

Stablecoins

-

-

- The volume of stablecoins as a whole has reached $258 billion ($126 for ETH), while after legislative decisions in the US (Genius Act), growth to $2 trillion is predicted (by US Secretary of State Bessent).

-

Real World Assets (RWA)

-

-

- RWA sector grew from $5.2 billion in 2023 to $24.3 billion today

- Analysts estimate that tokenizing 30% of global assets could lead to a $40–120 trillion RWA market by 2030–2034

-

Ethereum Dominance in RWA

-

-

- 95% of BlackRock’s BUIDL fund is deployed on Ethereum

- Securitize, with 15% market share in RWA, manages ~$3.7 billion in tokenized assets, of which 80% are on Ethereum

- The Ethereum Foundation restructured and launched Etherealize, a dedicated division to engage with Wall Street institutions

-

DeFi Integrations

-

-

- Securitize issued specialized tokens (sBUIDL, sACRED ) usable as collateral on Euler and Morpho

- Ethena utilizes USDtb, with 90% of reserves invested in BlackRock’s BUIDL fund

-

Conclusion

-

-

- Solana remains a retail-focused blockchain, excelling in meme coins, experimental applications, and user engagement (e.g., tokenized stocks via xStocks)

- Ethereum is positioning itself as the infrastructure layer for institutional finance, with RWA, stablecoins, and DeFi shaping the next phase of decentralized finance

- Based on current momentum, Ethereum appears better positioned to serve as the base layer for the next major liquidity cycle in crypto

-

Sources

-

- Solana Metrics:

🔗 Blockworks Research Tweet - Ethereum Metrics:

🔗 Blockworks Research Tweet

🔗 Trend Research Tweet

- Solana Metrics: