Exploring the future of digital economy

Solana: Technological Progress and Financial Performance in 2025

In 2025, Solana demonstrated significant growth both technologically and financially. Although the AI-meme boom has largely passed, Solana continues to show strength — its native token SOL increased from $90 to $150, while the network became faster and more stable than ever before.

This report outlines the major updates, financial metrics, ecosystem developments, and future outlook for Solana over the past several months.

Key Developments in 2025

Network Stability and Technical Enhancements

- Solana has maintained consistent uptime with no major outages, thanks to previous technical upgrades such as v1.18 , released in late 2024.

- Kompass, a new tool for auditing Rust-based smart contracts prior to deployment, was introduced, significantly improving security for developers.

- Development of Firedancer, a high-performance validator client developed by Jump Crypto, is ongoing, with a planned release in the second half of 2025.

Token Emissions and Growth Metrics

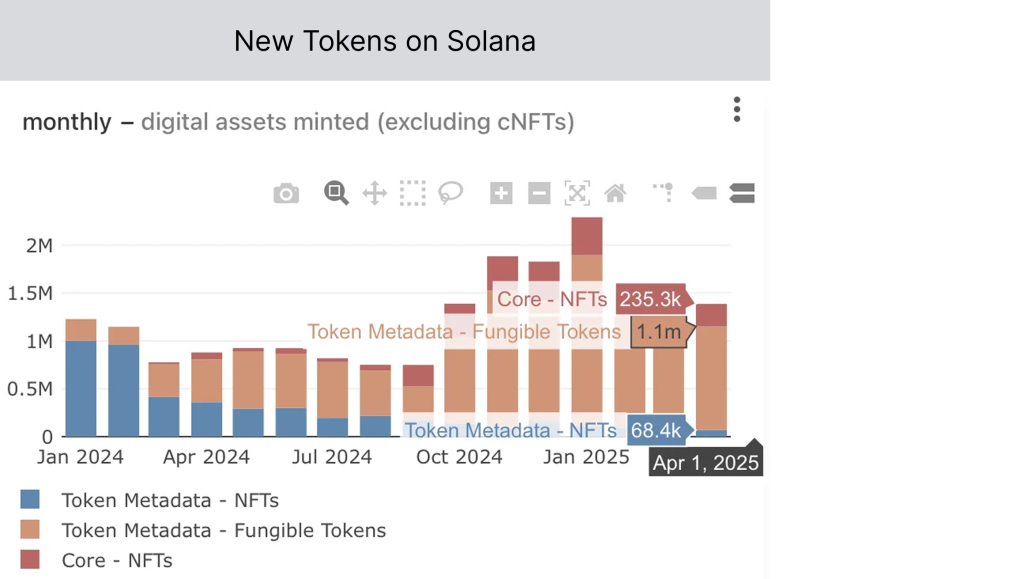

- In April 2025 alone, over 1.1 million new tokens were created on Solana — nearly three times the number of new ERC-20 tokens issued on Ethereum and its L2s in March 2025.

- This surge reflects the growing interest in launching new projects and deploying assets on the Solana blockchain.

Ecosystem Expansion and Community Engagement

Hackathons and Conferences

- The Solana Breakout Hackathon, offering a total prize pool of $50,000 across seven categories, including a student-focused track, is currently underway: Event Link

- The Solana Crossroads 2025 conference took place in Istanbul on April 25–26 , featuring over 100 speakers and drawing strong attendance from global builders and investors.

New Protocol Integrations

- 1inch announced its expansion to Solana, marking a major step in cross-chain DeFi interoperability: Tweet Announcement

Financial Performance and ETF Prospects

Token Price Surge

- SOL experienced a 60% price increase in April 2025, rising from approximately $95 to $150.

- Fully Diluted Valuation (FDV) surpassed $90 billion, reflecting strong investor confidence.

- A sustained support level at $140 held for over a week — the first such resilience observed in more than two months.

Spot ETF Momentum

- On April 15, Canada launched the world’s first spot Solana ETF (SOLL) by Purpose Investments, offering direct exposure to SOL and distributing staking rewards: News Source

- In the U.S., six companies have filed applications for spot Solana ETFs.

- Analysts at Bloomberg estimate a 90% probability of SEC approval, with a final decision expected by October 10, 2025.

Institutional Adoption

- BlackRock integrated its BUIDL fund ($1.7 billion) with the Solana blockchain.

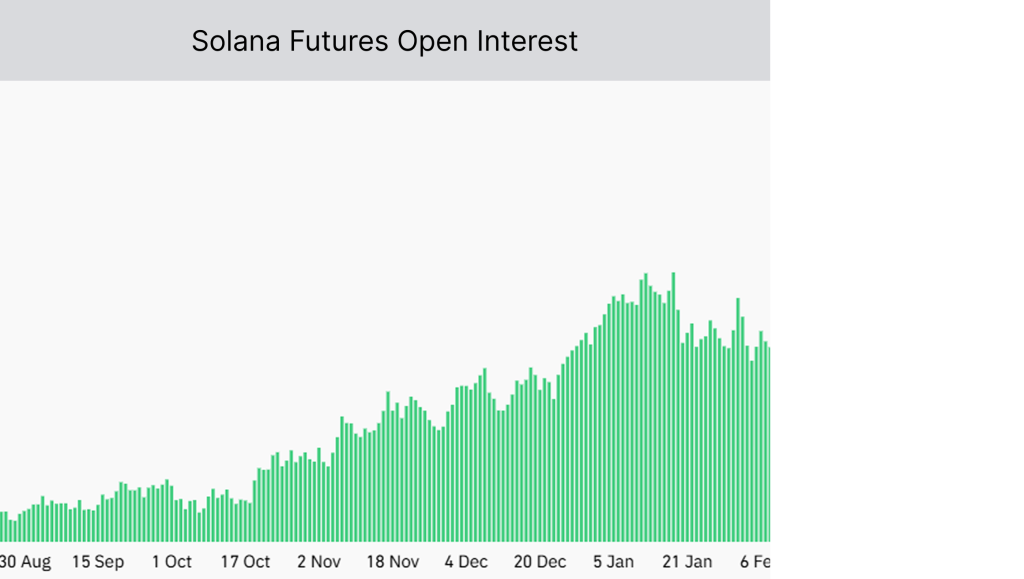

- CME Group launched Solana futures contracts.

- PayPal and Venmo added support for SOL, expanding retail access in the U.S.

Open Interest and Market Depth

- Open interest in SOL futures reached an all-time high of 40.5 million SOL (~$5.75 billion) on April 30, 2025, signaling growing institutional participation and hedging activity.

Governance and Strategic Initiatives

Leadership and Governance

- Anatoly Yakovenko, co-founder of Solana, expressed skepticism toward the proposed U.S. Strategic Crypto Reserve, citing concerns about centralization.

- The Solana Foundation established the Solana Policy Institute, aimed at engaging with regulators and shaping favorable legal frameworks for decentralized technologies.

Global Expansion

- In partnership with RockawayX, the Solana Foundation is developing Solana City in Dubai — an accelerator hub designed to support startups in the Middle East.

- RockawayX also launched a $125 million fund dedicated to Solana-based projects.

- Astra Fintech in South Korea announced a $100 million fund focused on Asian Web3 ventures.

Investment Activity by Solana Founders and Foundation

Anatoly Yakovenko’s Portfolio (2025)

Anatoly Yakovenko personally invested in five early-stage projects:

Solana Foundation Investments (2025)

The foundation invested in three promising startups:

Comparative Insight

By contrast, Vitalik Buterin and the Ethereum Foundation invested in only one project in 2025: Etherealize, a marketing and product arm for the Ethereum ecosystem.

Ecosystem Highlights

Decentralized Exchanges (DEXs)

- Raydium reported a week-over-week volume increase of 87%.

- Raydium also launched LaunchLab, a new initiative for creating and promoting tokens on Solana: Twitter Post

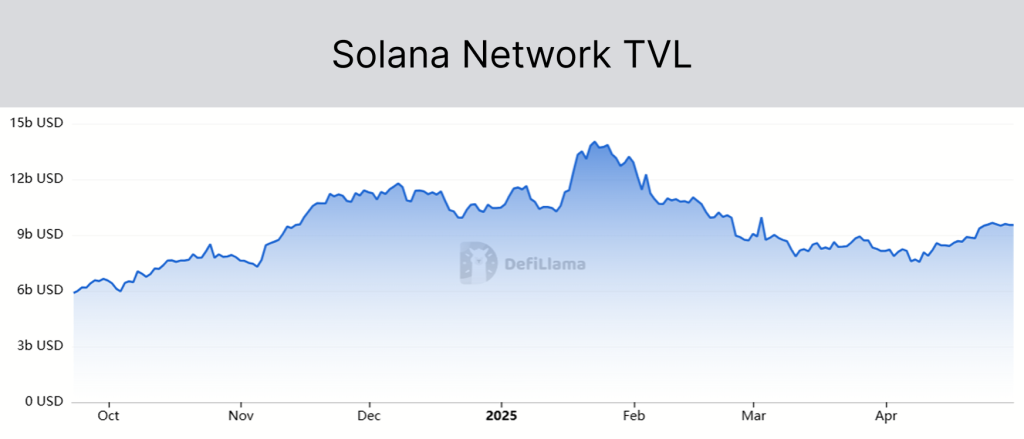

Total Value Locked (TVL)

- TVL across the Solana network reached $9.5 billion, indicating robust liquidity and user engagement.

Top Revenue-Generating dApps (7-day Fees)

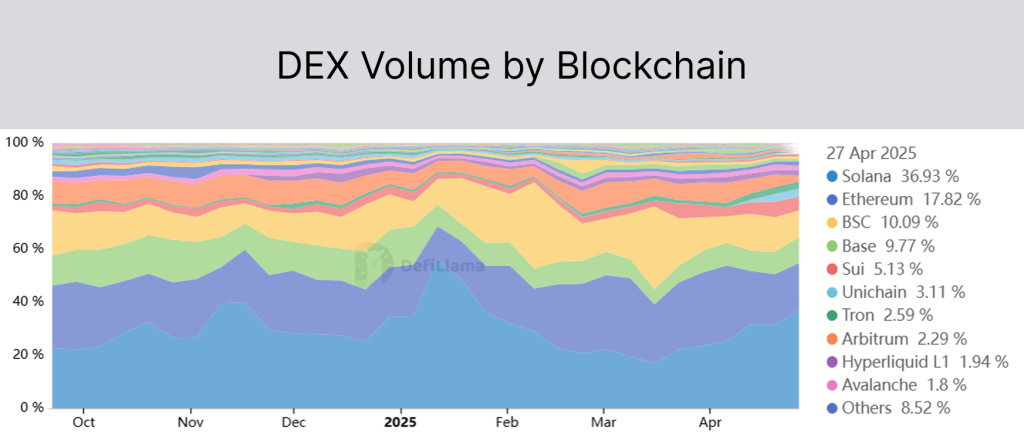

Trading Volumes

- Despite reduced gas fees on Ethereum, Solana DEXs outperformed Ethereum and its L2s by 90% in weekly trading volume, reaching $21.6 billion.

DePIN and NFT Developments

DePIN Projects

- Helium: DC payments grew from $67K to $206K per month.

- Hivemapper and Render expanded their use cases, introducing real-world applications like GPS mapping and GPU rendering.

NFT Market

- BONK acquired the NFT marketplace Exchange Art and saw a 100% price increase in April.

- Fartcoin surged by +450% during the same period.

Conclusion and Outlook

Solana has solidified its position as a leading high-performance Layer 1 blockchain in 2025. With continued technical innovation, a thriving ecosystem, and growing institutional adoption, Solana is well-positioned for long-term success.

Analysts project that SOL could reach $200 ahead of the anticipated approval of the spot ETF in the U.S., driven by improved network fundamentals and increasing institutional demand.

As regulatory clarity improves and global expansion efforts gain momentum, Solana appears poised to capture significant value in the evolving blockchain landscape.