Exploring the future of digital economy

Grayscale Research Insights: Crypto Sectors in Q3 2025

Summary

Grayscale Investments has released its updated quarterly analysis of the crypto market for Q3 2025, highlighting two key developments: the official inclusion of the Artificial Intelligence (AI) Crypto Sector and a partial recovery following the downturn in Q1. The report also reveals changes to the Top 20 list of digital assets, reflecting shifts in fundamentals and near-term outlook.

Highlights

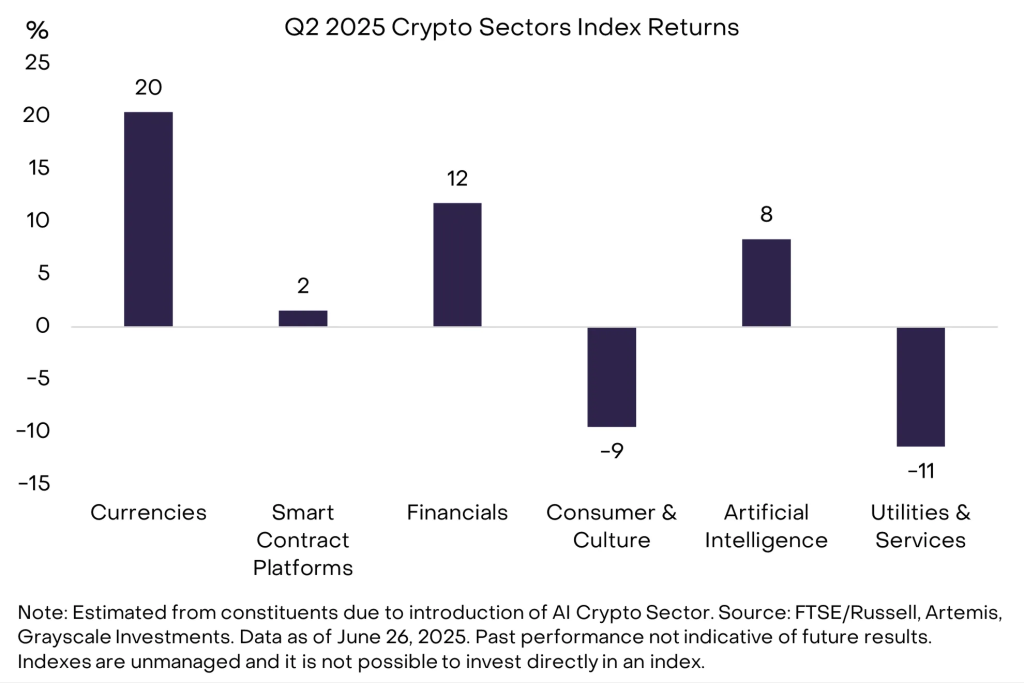

- AI Crypto Sector officially launched: Includes 24 tokens with a total market cap of $15 billion, up from $5 billion in 2023, showing an 8% quarter-over-quarter increase.

- Strongest-performing sector: Currencies (+20%), driven by a 30% rise in Bitcoin’s price.

- Other gainers:

- DeFi (+12%)

- AI-related tokens (+8%)

- Losers :

- Consumer & Culture (-9%) — impacted by weakness in memecoins and gaming tokens

- Utilities & Services (-11%)

- Transaction fees declined across sectors, averaging just $0.03 per transaction .

- Application layer revenues dropped 40% quarter-over-quarter, though still above year-ago levels.

- New additions to Top 20:

- Avalanche (AVAX)

- Morpho (MORPHO)

- Removed from Top 20:

- Lido DAO (LDO)

- Optimism (OP)

Sector Overview – Q3 2025

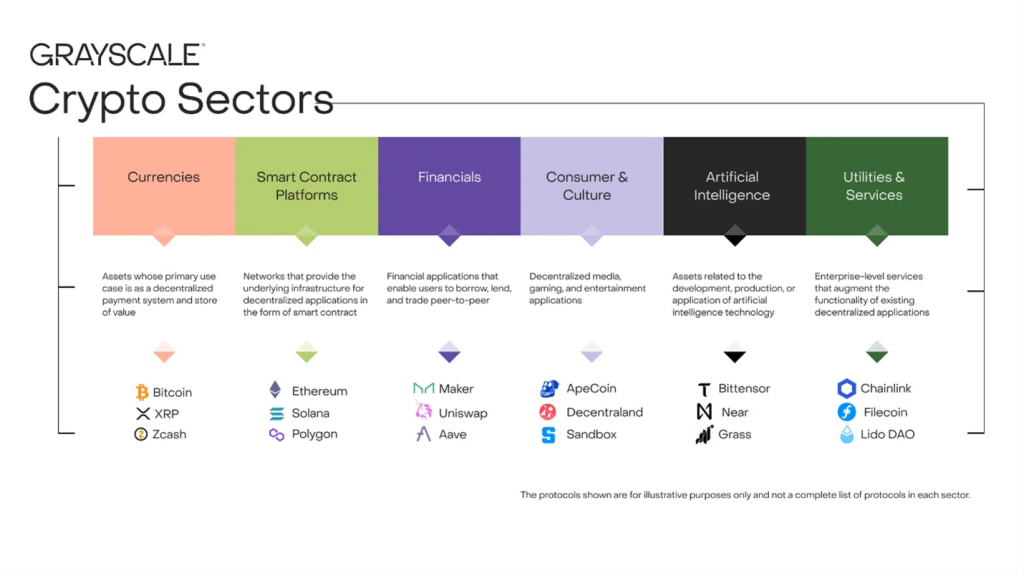

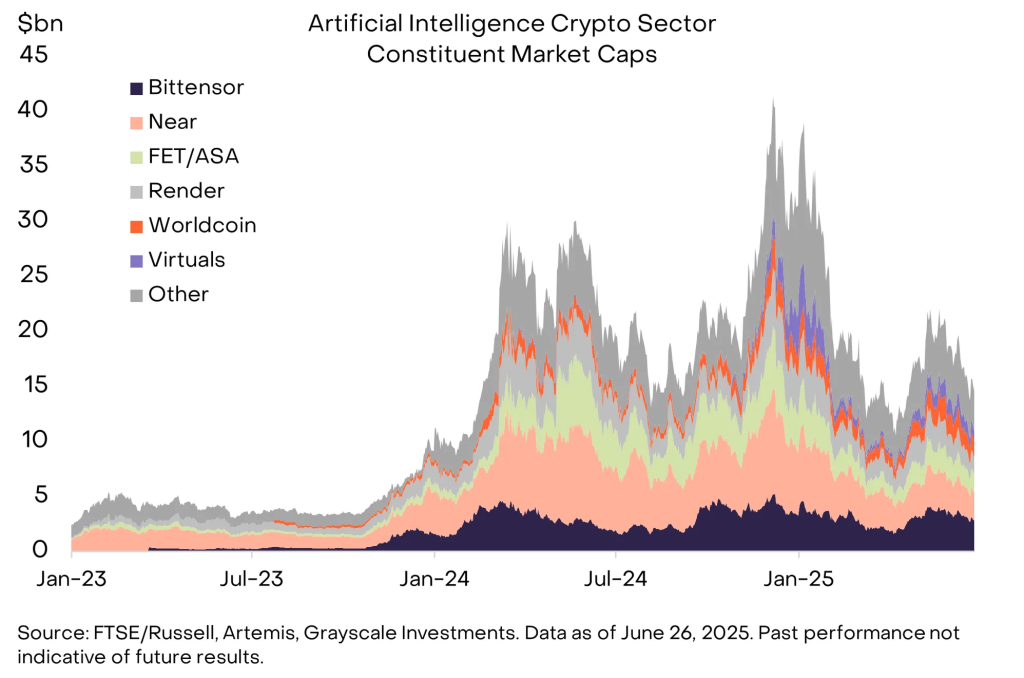

In June 2025, Grayscale formally introduced the sixth category in its proprietary Crypto Sectors taxonomy: the Artificial Intelligence Crypto Sector. This new segment includes 24 tokens with a combined market capitalization of approximately $15 billion , making it one of the fastest-growing segments within the broader digital asset ecosystem.

There were no major structural changes or notable project shifts in other sectors compared to the previous report.

Performance by Sector – Q2 2025

The second quarter of 2025 saw divergent performance across the Crypto Sectors:

The Currencies sector outperformed primarily due to strong gains in Bitcoin, which rose 30% during the period. Meanwhile, DeFi and AI-related assets showed moderate positive momentum, while consumer-facing tokens and infrastructure utilities faced headwinds.

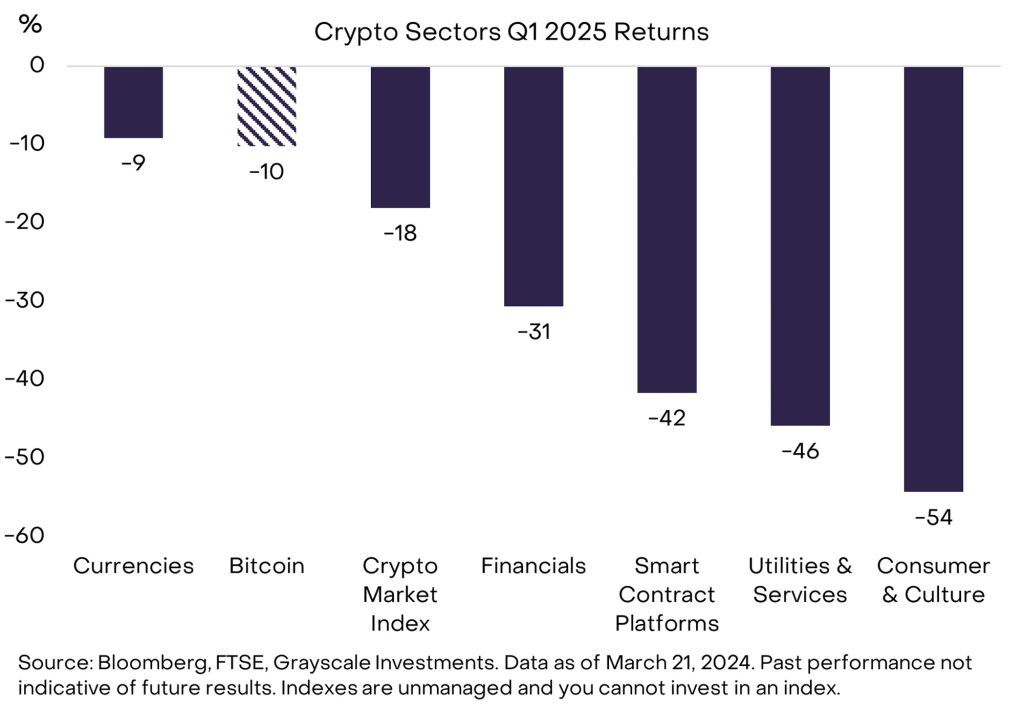

Comparative Context: Q1 2025 Performance

For comparison, all sectors experienced declines in Q1 2025 amid broader macroeconomic pressures:

The first quarter was marked by broad risk-off sentiment, particularly impacting speculative assets like memecoins and gaming tokens.

Fundamental Metrics

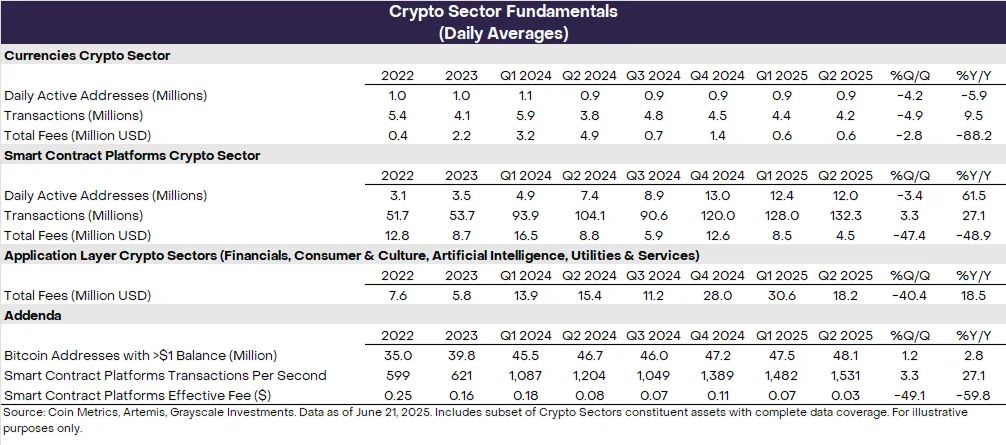

Despite mixed returns, blockchain activity remained robust:

- User growth continued: Smart contract platforms processed 133.3 million transactions on average in Q2, up 4.2% from Q1’s 128 million.

- Transaction fees declined sharply, falling from 7 cents to 3 cents per transaction.

- Application-layer revenue fell 40% quarter-over-quarter — from $30.6 million/day to $18.2 million/day, but remains higher than levels seen a year ago.

This suggests that while user engagement is rising, economic value capture remains weak in many sectors.

The New AI Crypto Sector

Grayscale’s newly integrated AI Crypto Sector represents protocols where artificial intelligence applications are the primary use case. Key details include:

- Total Market Cap: ~$15 billion

- Growth since 2023: Tripled

- Key Projects Included:

- Bittensor (largest by market cap)

- Near Protocol

- Fetch.ai (FET)

- Render Network

- Worldcoin

- Virtual

The sector reflects growing interest in decentralized AI development, incentivized through tokenomics and open-source collaboration.

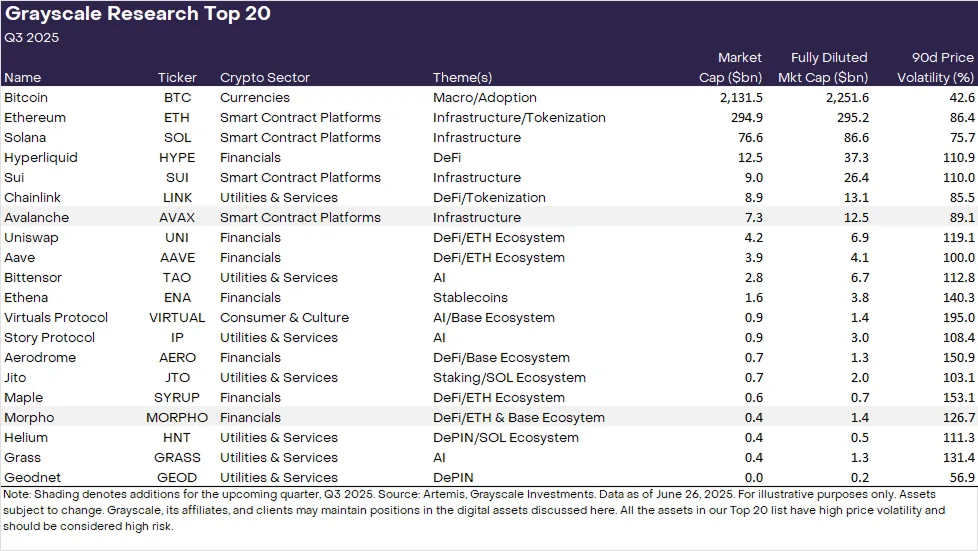

Grayscale Top 20 – Q3 2025 Update

Each quarter, Grayscale Research updates its Top 20 list of digital assets based on a range of criteria including network adoption, upcoming catalysts, fundamental sustainability, token valuation, supply inflation, and risk factors.

New Additions:

- Avalanche (AVAX) : Strong transaction growth and expanding DeFi activity.

- Morpho (MORPHO) : Boasts $4 billion in Total Value Locked (TVL) and generates about $100 million annually in protocol fees.

Removed:

- Lido DAO (LDO): Potential regulatory changes may allow centralized staking providers to compete more directly with Lido.

- Optimism (OP): Despite widespread use of its OP Stack in Ethereum Layer 2 solutions, fee accrual to the OP token remains limited.

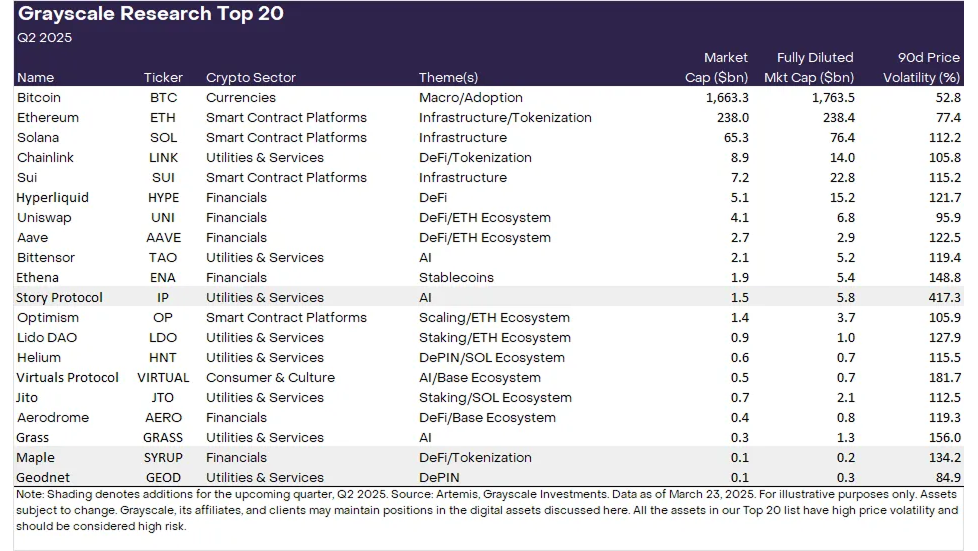

What Was New in Q2?

In the previous quarter (Q2 2025), Grayscale added:

- Maple Finance (MAPLE)

- Geodnet (GEOD)

- Story Protocol (IP)

and removed:

- Akash Network (AKT)

- Arweave (AR)

- Jupiter Exchange (JUP)

These moves reflected a focus on emerging non-speculative use cases such as real-world asset (RWA) tokenization, decentralized physical infrastructure networks (DePIN) , and intellectual property (IP) rights management.

Conclusion

Grayscale’s Q3 2025 Crypto Sectors update highlights both resilience and evolution in the digital asset space. While macroeconomic uncertainty continues to influence volatility, specific themes — especially AI integration, DeFi innovation, and blockchain utility — are gaining traction.

However, investors should remain cautious. As noted by Grayscale, all assets in the Top 20 carry high volatility and risk, and are not suitable for all portfolios. Any exposure should be considered carefully within the context of individual financial goals and risk tolerance.